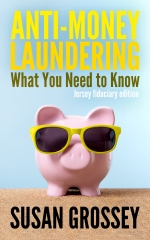

I’ve been hearing from friends in Guernsey that a recent industry presentation there suggested that the familiar three-stage model of money laundering – placement, layering and integration – is out of date. Granted, it dates from the mid-1980s, but then so does my car, and that’s still in top running order. Vintage status alone is no reason to discard something (otherwise plenty of us would be out on our ears). The only issue is whether it still works.

As I understand it (and please do correct me if you know better), the PLI model was developed by American academics in the run-up to the criminalisation of money laundering (which was achieved through the Money Laundering Control Act of 1986). In order to clarify just what was meant by “money laundering”, the process was broken down into the three stages: placement, layering and integration (or what I have always thought of as in, round and out). Since then, the terms have been in continuous use, although anyone who studies money laundering techniques for more than five minutes will quickly realise that the three stages are not discrete, but rather blend and mesh, and indeed that not all money laundering schemes involve all three stages (placement, for instance, does not figure if the value is already in the system, as with most fraud and embezzlement). Like all models of complex activities, it is a grand over-simplification. But as a basic explanation – the criminal gets his dirty money into the financial system, then moves it around to hide and disguise it, before bringing it out, under the guise of a cover story, to use it – it has served us well.

The alternative that has been suggested, I am told, is enable, distance and disguise. I’m quite taken with these terms – “enable” is particularly of the moment, as we hear more and more talk from the authorities of “professional enablers”. I also like the stress on distancing (of origin and ownership). But what this trio lacks is any linear motion: you can enable, distance and disguise at any stage of the money laundering process. But perhaps that doesn’t matter; do we need to suggest a progression, or is suggesting a progression actually misleading? My concern is that the whole purpose of a model is to simplify for those who need only a general overview understanding; those who delve deeper will soon abandon the effort to label any action as placement or layering or integration anyway. And for those who need a simple model, is enable, distance and disguise any better than placement, layering and integration? What do you think?

I prefer “placement, layering and integration”. “Enable, distance and disguise” is nebulous.

I think nebulous is a good word, Isabel – I’d worry about people trying to remember the “right order” of the three terms, when in fact there is no particular order – if only because we humans tend to like progressions and linear models.

Best wishes from Susan

Hi Sue, in the greater scheme of things I thought their model was not really any different when compared to the original PLI model, they seemed to be suggesting that as a result of the popularity of PLI people would be unable to identify money laundering in the absence of a suitcase full of cash at the start, but hey, he has a book to sell!

They did also talk about having a better understanding of the ingredients of the offences in the money laundering legislation and writing AML manuals to that as opposed to the âguidanceâ offered in the Handbook. No bad thing in my eyes as a former financial investigator.

At a personal level I think that the focus should not be on trying to rename something that is generally adequate as opposed to the regulators ensuring that business risk assessments properly reflect the risk posed to it and that the systems and controls mitigate and/or manage those risks accordingly.

By way of example we have almost no chance whatsoever of ever being used for placement as we donât hold accounts and all we take are non-refundable fees. That said we could easily be used in the layering/integration phase (we wouldnât necessarily know or be able to separate out which it was) but I donât think suddenly calling it distancing & disguise is going to give us a lightbulb moment enabling us to suddenly spot every money laundering scheme we may be exposed to.

Im reading the book of the next week or so as I am off to the SEC for some training next week so may have some further views for you after that!

Kind regards

Jon

Jonathan Richards | Int.Dip(AML) | Head of Regulation & MLRO | The Channel Islands Securities Exchange Authority Limited – Registered Number 57527

PO Box 623, Victoria Court, 5/7 Victoria Road, St Peter Port, Guernsey GY1 1HU | T Guernsey (+44) (0) 1481 713831 Ext 523 | T Jersey (+44) (0) 1534 737151 | F (+44) 01481 714856

The information contained in this e-mail is intended for the named recipients only. It may contain privileged and confidential information and if you are not an intended recipient, you must not copy, distribute or take any action in reliance on it. If you have received this e-mail in error, please notify us immediately by either telephone 44 1481 713831 or e-mail to the above address. Any views expressed in this message are those of the individual sender, except where the sender specifically states them to be the views of The Channel Islands Securities Exchange Authority Limited

I agree with Jon. It doesn’t seem much different. In 2013 a colleague of mine named Mike Ryan posted this article about a money laundering model suggested by John Broome. Broome’s model has six stages: Generation, Consolidation, Placement , Layering, Integration and Realization. I use Broome’s model when I teach criminal investigators. Here is a segment from Ryan’s article:

To date, the traditional model for understanding money laundering has been that of ‘Placement – Layering – Integration’. This has been the standard method of analysis employed by international bodies, law enforcement, regulators and private sector practitioners. This description of proceeds of crime in motion, viewed as a flow that enters and passes through various forms to exit, at a different place and ostensibly appear as originating from an alternative source, has been the main tool to describe the increasingly complex world of sophisticated profit-motivated criminal activity. The major flaw of this traditional model has been that its application is, for the most part retrospective, and therefore it offers few predictive indicators.

The traditional model engages only when the subject matter of a transaction is tainted by or is used in conjunction with some criminal or illicit act. Without that predicate association to criminality it is not possible to distinguish the first stage (Placement) from thousands of identical transactions. The model offers little proactive analysis into the subject matter of the transaction itself – the criminal activity that generates the proceeds of crime at the onset. Furthermore, the model does not easily accord with fraudulent criminal activity where the proceeds of those crimes are already on deposit – the Placement stage appears to have been sidestepped. In the ever expanding world of Internet-based crime and virtual payment mechanisms such as BitCoin, criminally derived proceeds will become increasingly oblivious to discernable Placement mechanisms. Historically the model has conformed best to cash-based criminal activity, and therein lays its greatest weakness. Without a mechanism to analyze the origin of the proceeds of crime, law enforcement and to a greater degree due diligence efforts are limited to monitoring for suspicious deposit typologies, and regulated reporting based on quantity deposit frequency, assembly characteristics, and contaminants.

John Broome, former Chairman of the Australian National Crime Authority, in his book proposed an expanded money laundering model to “…identify in the money laundering process the point at which the criminals are most vulnerable to detection.”1 Broome buttresses the traditional model with the concepts of Generation and Consolidation prior to Placement, and follows Integration with a sixth stage described as Realization.

Generation – Consolidation – Placement – Layering – Integration – Realization

Broome’s model broadens the analysis to consider the source of the proceeds of crime and the preparatory conduct which always occurs before the Placement event – not just an analysis of the activities undertaken during the interaction with the financial sector. The Generation stage seeks to identify the criminal source(s) and gives context to the Placement efforts by examining for indicators of the predicate criminal activity. Historical and current criminal activity indicators provide the opportunity to examine for the Generation of proceeds of crime.

The Consolidation stage recognizes the assembly process that has application to both cash and non-cash-based financial crime environments, and it addresses the preparatory efforts required to enter the Placement stage. During the Consolidation stage there will be indicators of association with persons or entities that form nominee relationships, which are essential for the successful completion of a money laundering event. Criminally derived wealth meets at points of compromise where there is expertise and opportunity to enter the traditional money laundering cycle, and that cohesion is an event itself. Consolidation includes the formulation and perfection of nominee relationships that separate ownership and beneficial interest, and stymie efforts to truly ‘know your client’. Combined, Generation and Consolidation serve to pull the analysis back to engage predictive indicators that are preparatory to Placement. The analysis now has a structure upon which to evaluate for vulnerability prior to Placement.

Following the traditional third stage of Integration, Realization recognizes the reconnection of the criminal with the laundered proceeds of crime on the basis of an expanding level of wealth. Realization presents a vulnerability risk, based upon the inordinate quantity of that wealth and the timing of its acquisition. Also important is that as a stage, Realization recognizes the movement of laundered proceeds of crime beyond Integration. That allows Integration to be viewed as a process to be examined for similarity or differences across the range of assets that have flowed through the money laundering event.

Expanding the analysis to include these preparatory and terminating stages ensures that a broader range of meaningful inquiries can be made, and the expansion permits the development of predictive indicators that are associated with the predicate and ultimate criminal behavior. Law enforcement efforts in most jurisdictions will require confirmation of the predictive indicators at all six stages, but regulators and private sector practitioners will require fewer indicators to be confirmed depending upon the level of risk their respective industries mandate.

In at least one common-law jurisdiction, Broome’s model has been applied and a working list of predictive indicators assembled. This expanded model and its associated predictive indicators operated so effectively that policing resources were more efficiently deployed and prosecution costs minimized. Due diligence requirements that do not carry the criminal burden of proof may find this method useful.

Dear Ken

Welcome to the blog. Thank you for your detailed comment; I am still digesting it and will reply properly later, but I wanted to approve it quickly so that other blog readers could see it.

Best wishes from Susan

Hello again Ken

I’ve now had time to read your response in full. And it has something in common with Robert’s more recent comment below, in that it highlights the inadequacy of the PLI model for law enforcement purposes. As you say, it is not much good for predictions.

To be fair to the PLI model, I don’t think it was ever intended – or at least, not for long – for use by dedicated financial investigators. They would quickly see its limitations and, indeed, might not need a model at all, as their job would be to determine the facts of each individual case, not to look for similarities. Although, as I write that, I do wonder whether investigators also look for patterns in order to link cases, and perhaps to predict criminal intent.

I very much like the added “realisation” stage, particularly as it presents a vulnerability – a point at which the criminal might more easily be spotted.

Best wishes from Susan

Dear Jon

Yes, I had heard about the book – it’s on my list of books to read. But if you get to it before I do, we would all appreciate a quick review!

In my training, if I mention PLI I am always sure to point out that not all businesses are susceptible to all three stages – and in some ways it makes the model more useful, as I get people to guess which stages are “theirs”, and what their businesses offer that could be used during those stages. Of course, this approach would work with the new model as well.

Best wishes from Susan

Obviously I come at this form a very different angle, since we use the term money laundering perhaps a bit too broad fashion (Anything a suspect criminal does with money we think is laundering) but for interest I mention the following.

In my little corner of the Law enforcement world we’re moving away PLI model too because we consider it a bit too simplistic and this has influenced the way people have policed it (in generally, not as well as perhaps they might). What we have tried to do under advice from experts is instead of starting with a model of what money laundering is and then looking for it, we consider what our suspects are trying to do with the money. PLI might describe a good general process for making money look like illegitimate income but it doesn’t describe how said criminal would for example reinvest funds for more “product”. It doesn’t adequately describe the twisty way a lot of criminal’s convert currency to electronic form or into other currencies (To avoid the scrutiny of people like your good selves). It doesn’t help with some of the Informal Value transfer systems, culturally based or otherwise. I guess in Short PLI is really only good for looking at what money loaundeirng looked like before MLOs existed and people started looking for it!

So instead we have started using terms like “Raising” “Moving”, “Transforming” et cetera to describe what is actually happening to the funds we’re looking at which has encouraged us to look at the problem a bit more widely and come up with better investigative options.

Dear Robert

I wonder whether you have read Ken’s comment above – you and he have much in common, with your investigative roles.

And you’re right to point out that PLI entirely ignores e-currencies – which of course were science fiction back in the 1980s!

Again, I like raising, moving and transforming – all excellent terms. But I do wonder whether – for a basic introduction – a more linear description still has its place. Investigators of course can get to grips with the twisty nature of laundering, the overlapping movements and the doubling back of some transactions. But for newbie staff, just being introduced to the whole concept of dirty money, I still like the idea of in, round and out. Aren’t I a stick-in-the-mud?

Best wishes from Susan

I missed Ken’s comment when I first replied, back to detective school for me. I saw it after I posted so we did both make the same point twice (sorry for repetition) if with a slightly different flavour. It is I guess horses for courses I do not need to think of ML in the same way a MLO needs to or even as a everyday bank worker might (should?), I am not looking for risk so much as investigative avenues or prevention opportunities.

In, round and out makes it all sound like dance steps. The Hookey-cookey method perhaps…

Well, there are plenty of light-footed (and light-fingered!) people involved in money laundering, that’s for sure.

And it is always very useful for everyone involved in AML to hear about it from another angle – MLROs need to know what the investigative priorities will be, and investigators need to know the commercial realities faced by even the most dedicated MLROs. So please do keep commenting with your investigator’s hat (helmet?) on.

Best wishes from Susan

could i konw to types of predicate criminal conduct that would not require money to be “placed”?

Hello Gianluigi, and welcome to the blog. If money is already in the system – in a bank account or an investment or in the form of an asset or property – and then is stolen and put into another name, that is not placement: it is already integration. Placement (according to this model, anyway) is really all about putting cash into the financial system. The most common predicate crime that does not require placement – because the money is already in the financial system – is probably fraud.

Thanks for the answer. But it could also be the purchase of Bitcoin a way to skip the placement phase?

These sources might help, Gianluigi: https://www.fraud-magazine.com/article.aspx?id=4294993747 and http://www.fatf-gafi.org/media/fatf/documents/reports/Virtual-currency-key-definitions-and-potential-aml-cft-risks.pdf

It depends on how you purchase Bitcoin: if you use cash, it’s placement, but if you use a bank transfer, then it’s layering. However, I am not sure – as the original post says – that the terms matter that much. In short, yes, Bitcoin can be used for money laundering.

I thank you so much for your help and the advice you give me