And so here we are: my final weekly blog post. I could think of no more fitting topic than my top five tips for MLROs, garnered over twenty-five years of working with you.

- Get people to care. It’s all very well reminding staff about the legislation and penalties, about your policies and procedures, but we all know that no-one works to their highest standard unless they care about what they’re doing. So tell them about people trafficking and drug overdoses and the sale of child pornography and the poaching of wild animals and the theft of state assets and how their tax bills are higher because so many people are evading their obligations. And explain that money laundering is the crime that allows all other crimes to flourish – and that AML is our best weapon against it.

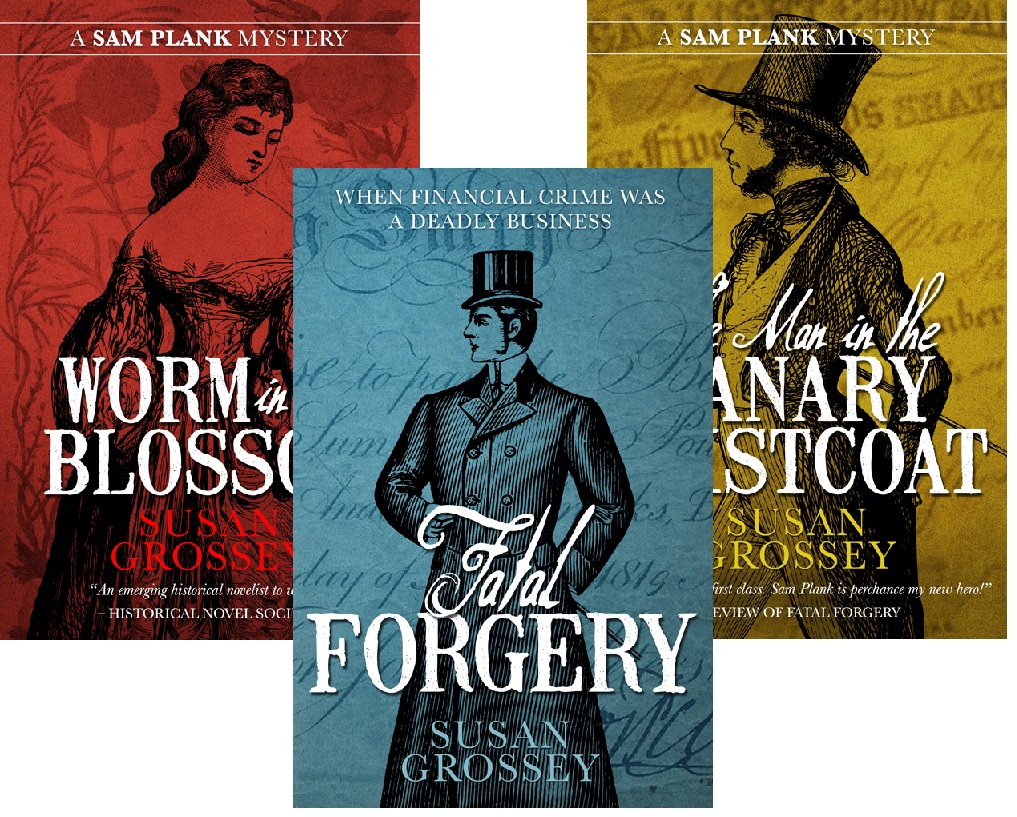

- Tell them stories. Yes, I know your staff and directors are all grown-ups, but we all love a good story. So research the latest money laundering convictions – particularly those that involve your sector and your type of clients (and you know there will be some) – and turn the bland details into an exciting tale of the triumph of AML (or at least, the triumph of money laundering investigation) over the forces of evil.

- Record everything. We all agree that the risk-based approach is the most sensible, as it allows you to vary your AML according to the risk presented, but the price you pay for that is that someone in the future could question your decisions. Did you assess the client correctly? Did you put them into the right CDD category – and was that CDD applied without fear or favour? To protect yourself, record it all: every client interaction, every search for corroboration, every deliberation, every decision. Drum it into your staff that file notes are an essential part of it all – not just filling in the standard forms.

- Meet other MLROs. You may be the only MLRO in your firm. But even if you are lucky enough to have a compliance team around you, so that you can bounce ideas around and discuss tricky situations, you will only be seeing things from the perspective of your own firm and your own sector. Join MLRO groups so that you can meet others and see the problems and solutions from a different angle. They may well have already cracked the vexatious issue with which you have been wrestling. Which leads me to my final tip…

- Be generous. Give freely of your time and your expertise. When I started out in AML – in the early days of the Industrial Revolution – I was quite guarded about “giving away” my information. But then my natural blabbermouth emerged and I discovered – miraculously – that the more I shared, the more I was given in return. I would email someone a relevant news story – and a month later they would send me a copy of an expensive industry report. I would take a quick look at someone’s AML policy – and a year later they would commission me to rewrite their whole manual. But don’t just do it for what you can get out of it: we’re an AML community, and it’s only by co-operating and sharing that we will succeed (and enjoy it while we do).

And one very last observation, if I may. When people say to you (and they will) “but what’s the point of AML – as long as there’s money there will be crime and money laundering”, just remember this. For everything in life you have only two options: do something or do nothing. Doing nothing in the face of money laundering was never possible for me – nor, I assume, for you – and genuine effort is never wasted. If you have made life awkward for even one criminal, if you have blocked even one penny of criminal proceeds from moving through the financial sector, you have done more than most people and that’s a triumph. I salute you all.