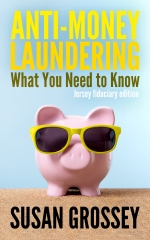

I have been doing some research into SCPOs. No, not the gold chap from “Star Wars” – I mean Serious Crime Prevention Orders. Once a convicted criminal has served his time in prison, it is often wise not only to keep an eye on him via the probation system, but also to put restrictions on his future activity in order to remind him of the foolishness of taking up where he left off. To this end, the UK law enforcement has a programme of “lifetime management of serious and organised criminals”. And part of that programme includes, when considered necessary, applying to the courts for offenders to be handed Serious Crime Prevention Orders, Financial Reporting Orders and Travel Restriction Orders – all examples of ancillary orders, as they are extra to the main sentence. For those of you interested in criminology, the purpose of these three orders is purely preventive – they are not viewed as punitive (although those subject to them might disagree).

Those of you committed to the fight against financial crime – including the biggest baddie of all, money laundering (boo hiss!) – will be pleased to hear that SCPOs and FROs are targeted specifically at our enemies. SCPOs can be applied to individuals and bodies corporate convicted of a “serious offence” (including drug trafficking, slavery, human trafficking, money laundering, fraud, tax offences, bribery, blackmail and organised crime) and can place prohibitions or restrictions on the subject’s financial, property or business dealings, working arrangements, association and communication with others, premises to be used, use of any item, and travel within UK and abroad. An SCPO can last for up to five years. FROs do exactly what you might imagine: those convicted of financial crimes (such as fraud, theft, money laundering, bribery and tax evasion) can be compelled to “make a report” of specified financial information for the duration of the order – perhaps a monthly report of all their financial activity. In the most serious cases – for those sentenced to life imprisonment – a FRO can last for twenty years. TROs are the most limited of the trio, in that they can be issued only following a conviction for a drug trafficking offence with a term of imprisonment of four years or more; the effect of a TRO is to restrict the travel of the offender for at least two years after release.

So why should MLROs care about SCPOs, FROs and TROs? In short, it is handy to know whether one of your clients is actually subject to one which seeks to curtail his financial life, so that you can be sure you’re not unwittingly helping him to evade those restrictions. It sounds like a hassle, but – although I love these orders and the balance they restore to the world (if someone commits a financial crime, you make their financial life more awkward) – there are not that many in operation at any one time. In fact, if you have an idle moment with your elevenses, why not take a look at the current list? That’s right: it’s all public and very easy to understand: it tells you who has an order against them, when it started and when it finishes, and what sort of restrictions it places on them. If it says “dormant” rather than “live”, that means the order is poised, ready to come into force once the subject is released from prison. Do you think it turns up at the prison gate in a battered old Mercedes wearing a tatty fur coat and clutching a bottle of cheap champagne – or have I been watching too many episodes of “Minder”?