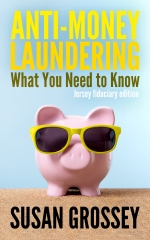

From time to time I have a rant about the bad rap that AML gets, and today’s another one of those. Allow me to present two pieces of evidence. A fortnight ago I found a wallet on a bench in Cambridge. I looked inside, and there were a card to allow reduced price on the local buses, a £20 note, and a cashpoint card for a bank, with a PostIt note stuck on it with the PIN. I know, I know. A branch of the bank in question was just round the corner, so I took the wallet in. “Could you just confirm,” I asked, “that you have a telephone number on file for this gentleman, so that you can return his wallet.” “No,” said the girl on the front desk that all bank branches seem to have these days. “We can’t tell you whether he is a customer or not because of money laundering.” Now, if she had said – in polite terms, of course – because you might steal from his account, that I could understand, although quite why I would go into the branch when I could simply go to an ATM with his card and PIN and strip his account, I can’t imagine. But no: the reason she couldn’t tell me anything was “because of money laundering”.

And yesterday I found that somewhere along the line I had acquired a damaged £20 note – a small strip of it was torn off one edge. I went into a branch of my own bank and asked to exchange it. “We can’t just give you another £20 note,” said the man at the counter, “but we can pay it into your account.” “Why’s that?” I asked. You’re ahead of me here. “Because of money laundering,” he said without hesitation. I was in quite a good mood that day, so I didn’t challenge him to explain how exchanging one £20 note for another might be considered money laundering, when paying the £20 into my account wasn’t – did they consider it the proceeds of crime, or not?

But it does worry me that “because of money laundering” is used so glibly, as a catch-all explanation. Firstly it is just plain wrong, and it upsets me that staff in large UK banks – these two are among the very largest – are still being given the wrong information. And secondly, it makes people (I assume they’re giving the same explanation to other clients as well as to me) think that AML is just ludicrous – that it makes illogical demands of the financial sector, thereby stopping them doing perfectly acceptable things like swapping one £20 note for another. Stamp, stamp, stamp go my little AML trotters!

Scarily and sadly, your experiences demonstrate that the basic fundamentals of ML and AML are completely and utterly misunderstood…..and by personnel in the ‘front line’. During my banking tenure, I witnessed an attitude to ML and AML training by even the most senior management, that was primarily a tick box exercise that they viewed as being necessary to satisfy scrutiny from audit, head office or regulators. Time and time again….from within my own experiences and those of others, ensuring real understanding is seemingly only a concern for the AML and Compliance Ooficers…..as when those officers voice concerns regarding weak AML understanding among employees at all levels, sufficient officers/resources to complete the training and/or difficulties in ensuring personnel were released from duties to attend training….the management response is invariably, that AML and Compliance Officers are not exercising their obligations correctly….with little to no recognition of the risks to which the bank, its clients and employees are exposed.

How do we fix this when its down to an internal culture that requires the most senior executives to trickle down into their organisation….when those executives are not being held accountable by the relevant bodies …..and are allowed to escape punishments that befit the crime….with settlement of fines that they now just viewed as irritating but the cost of doing business?

I couldn’t agree more, Sue – it’s got to come from the top, with genuine commitment and a desire to put things right (or keep them right). And when you see firms “putting aside” money to settle later, as yet unknown, penalties, it’s as you say – “irritating but the cost of doing business”. Where is the professional pride in wanting to do it properly, and the shame in being caught cutting corners?

Best wishes from Susan

Perhaps if I can put a few more (or indeed any) CFO and the like in prison, the message will become crystal clear…

We’re right behind you, Robert!

Hammer Nail Head, Susan and Robert! In my career, I witnessed three distinctly different types of top executives who held the requisite autonomy and seniority to influence internal culture. Firstly, the minority due to their short ‘life’ span. This group were executives that just knew what the ‘right thing’ is and would strive to do it. Even at the most senior levels, their careers did not last very long, especially when they put robust regulatory culture ahead of profitability, and they rarely left with notice. Secondly, another minority. In small numbers …..due to their position at the top of the hierarchy. Usually only in one-to-one meetings, these executives would arrogantly indicate that the advice and guidance did not apply to them or they would argue that issue in question was being assessed incorrectly…..despite unprecedented levels of information and documentary evidence to the contrary. They would convince other executives, whom usually reported to them, that their view was correct…or at least persuaded them that this was the route of least resistance for them to follow (eg. my way or the highway). They would aggressively control the agenda, duration and flow of any official forums, thereby either avoiding or downplaying the compliance issue. I even witnessed several occasions when Compliance Issues were the final agenda item, only for the meeting time to expire and matters were left unaddressed completely with protestations unheard. Thirdly, the majority. The executives who truly wanted to do the right thing, who would privately agree with and support my views regarding AML weaknesses and Compliance constraints, yet kept their heads down in more official forums and did not provide open support. Some would even admit that they were just not prepared to ‘stick their heads above the parapet’ while the bank measured performance achievement and success against other objectives and doing so could adversely impact their career or financial recompense…..as in the first group. Thus, the first group will likely turn into the second or third groups when their families are impacted by the results if their actions. For the second group, they appear to retain their sense of pride through being praised and rewarded for meeting job objectives by their own line management. Even though risk matters would feature in objectives, the reality of a performance review would be heavily weighted in favour of financial profitability….even for compliance officers! Until such time that regulators have the appetite to investigate issues more fully and punish individuals to the full extent of applicable legislation, tick box mentality will continue, with groups two and three increasing at the expense of group one.